OUR OFFERof mandates

A UNIQUE MANAGEMENT APPROACH

DISCRETIONARY MANDATE

We take care of the management of your portfolio.

You choose the risk level, we do the rest.

✓ Regular status updates at the pace you need.

✓ 4 investment strategies

✓ Rigorous risk level management defined by risk budgets

✓ Total protection against the risk of currency fluctuations

✓ Direct line approach to limit fee overlay

✓ Foreign exchange and currency hedging operations at institutional rates

✓ No brokerage fees for routine management transactions

✓ Monthly newsletter on financial markets

ADVISORY MANDATE

We accompany you in the management of your life savings.

You keep control of your investment decisions.

✓ Regular status updates according to your needs

✓ Monitoring of the defined risk level

✓ Brokerage and exchange rates negotiated with our custodian banks

✓ Customized strategic interview

✓ Personalized investment ideas

✓ Access to the research of our partner banks

✓ Monthly newsletter on financial markets

✓ Consolidation of your assets through our digital tool My MFM

Risk management at the center of our concerns

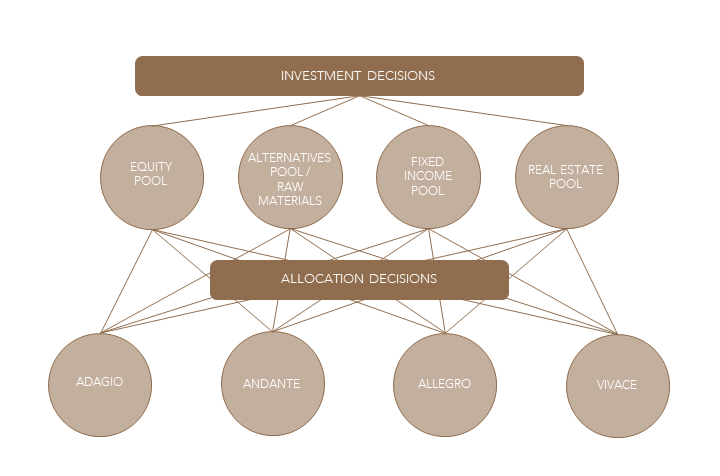

MFM manages risk budgets by asset class (equity, bond, real estate, alternative). Each pocket receives a well-defined risk budget that the pocket manager must respect. Each pocket is managed independently by the dedicated manager. Investment decisions are separate from allocation decisions. For the creation of the investment strategy (Adagio, Andante, Allegro and Vivace), our investment manager allocates a certain percentage of each pocket according to the global risk budget assigned to the strategy (see chart below). Thus the asset allocation is totally dependent on the defined risk budget and not the other way around. At MFM we manage the allocation according to the risk in a rigorous and continuous way!

No conflict of interest

Your investments are made in direct lines. We do not use structured products or other investments whose costs are not transparent. We are only remunerated by our clients. We do not receive any retrocessions from partner banks or issuers of funds or products used for your management. These conditions are essential to guarantee the neutrality of your management.

Low and transparent costs

In Switzerland, the average total cost of a management mandate is 2.6%. At MFM, these costs are significantly lower. Thanks to the use of our investment funds via direct lines, clients benefit from the volume effect of transactions carried out for all investment decisions in the asset class pockets (reduced brokerage fees) as well as for all currency hedging executed on a daily basis (reduced foreign exchange fees). What’s more, unlike other players, we do not double dip (deduct fees twice through the use of other internal financial products).